Need Quick Cash? Personal Loans in Orlando, FL – Easy 5-Min Application

Your car breaks down on I-4 during rush hour, your AC unit dies during the hottest week of Florida summer, or maybe your child needs an emergency dental procedure. Do life’s unexpected expenses rarely wait until your bank account is ready?

When you need money fast in Orlando, you don’t have time to waste on lengthy bank applications and endless waiting. The good news? You can find reliable personal loans in Orlando, Florida, through a simple 5-minute online application. While traditional banks might keep you waiting for days or even weeks, online lenders can connect you with funding options that match your needs right away.

Say goodbye to mountains of paperwork and hello to a streamlined process that takes you from application to funding without the usual headaches. This guide walks you through everything you need to know about securing quick cash through personal loans – from figuring out if you qualify to getting funds in your account as soon as the next business day. You’ll discover how to navigate the application process, what documentation to have ready, and smart ways to manage your loan repayment.

When Personal Loans Make Sense for Orlando Residents

Life in the Sunshine State isn’t always sunny when it comes to your wallet. Financial emergencies can strike Orlando residents without warning, leaving you scrambling for solutions when you least expect it. Personal loans offer a lifeline when those unexpected situations demand immediate attention. Let’s explore when these loans make the most sense for your financial needs.

Common financial emergencies

Picture this: you’re heading to work on I-4 when your car suddenly makes that dreaded grinding noise. Or maybe you’ve just discovered a leak in your roof right before hurricane season. These situations don’t politely wait until your next paycheck arrives.

Vehicle repairs and transportation issues top the list of financial emergencies in Orlando. In a city where commuting is a way of life, a broken-down car isn’t just an inconvenience—it’s a threat to your livelihood. When your car needs immediate attention, a personal loan provides the funds to cover repairs or even purchase a replacement if needed.

Medical expenses can blindside even the most prepared among us. Even with insurance, that trip to AdventHealth or Orlando Health might leave you with hefty out-of-pocket costs. Hospital bills, emergency procedures, and specialized treatments can quickly drain whatever savings you’ve managed to set aside.

Home repairs present unique challenges for Orlando homeowners. Florida’s climate doesn’t play nice with procrastination:

- Hurricane damage that can’t wait another day

- AC system failures during those brutal summer months

- Sudden plumbing emergencies that threaten your property

- Roof repairs after one of those famous Florida thunderstorms

Family emergencies like unexpected funeral expenses or last-minute travel needs can create immediate financial pressure. When a family calls, you need solutions faster than traditional banks can provide.

Utility disconnections represent another urgent scenario. When your electric or water service is cut off, a personal loan can bridge the gap until payday, helping you avoid the extra fees and hassle of service restoration.

Remember, unlike payday loans that demand full repayment by your next paycheck, personal loans in Orlando offer structured payment plans spread across multiple pay periods. This makes them much more manageable when you’re facing financial challenges.

The online application process makes access to funds remarkably simple. Submit your application before 3:30 PM EST, and you might see same-day processing with funds deposited directly into your checking account. When you’re dealing with a genuine emergency, this quick turnaround can make all the difference.

Advantages over credit cards and payday loans

When financial emergencies strike, you have options—but not all of them are created equal. Personal loans offer several key benefits that make them stand out from credit cards and payday loans.

Structured repayment plans give you clarity from day one. Unlike credit cards, with their constantly changing minimum payments, personal loans come with fixed payment schedules. After approval, you’ll receive a detailed payment schedule showing your exact due dates and payment amounts. This predictability makes budgeting much easier during already stressful times.

Payment flexibility puts you in the driver’s seat. Need to pay more than your scheduled amount? Go right ahead! You won’t face penalties for paying extra on due dates. This flexibility helps reduce your overall loan term and potentially saves you money on interest. Most lenders use automated ACH withdrawals from your checking account, ensuring timely payments while giving you one less thing to worry about.

Customized payment schedules align with how you get paid. Payment options typically include:

- Bi-weekly payments that match your regular paydays

- Semi-monthly payments for mid-month and end-of-month income

- Weekly payments if you’re paid every week

This alignment makes managing repayments significantly easier than juggling credit card or payday loan deadlines.

Accessibility for varied credit backgrounds opens doors that might otherwise remain closed. Many personal loan providers look beyond just credit scores, considering your banking activity, employment stability, and consistent income. This comprehensive approach creates opportunities for people in different financial situations.

Higher loan amounts give you more breathing room. While payday loans typically offer smaller amounts with extremely short repayment periods, personal loans provide more substantial funding with extended repayment terms. This makes them suitable for larger emergencies like major car repairs or medical procedures.

Transparent fee structures mean no surprises down the road. After approval, you’ll receive a detailed loan offer showing your exact loan amount, payment schedule, and complete fee structure. This transparency stands in stark contrast to credit cards with their variable interest rates and ever-changing minimum payments.

Personal loans also differ fundamentally from payday loans in their approach. Payday loans demand full repayment by your next paycheck, often trapping borrowers in a cycle of debt. In contrast, installment loans spread payments across several pay periods, helping you avoid the “rollover” trap that many payday borrowers experience.

It’s worth noting that Florida law permits you to have only one active installment cash advance at a time. This regulation helps prevent the pile-up of multiple high-interest debts that could lead to financial distress.

For Orlando residents needing quick financial solutions, personal loans strike a balance between accessibility and responsible borrowing. Their structured repayment options, flexible terms, and straightforward online application process make them particularly well-suited for those genuine financial emergencies when you need funds quickly but can repay them over time.

Finding the Right Personal Loan in Orlando, Florida

Looking for the right personal loan in Orlando feels a bit like searching for the perfect Cuban sandwich – everyone has their recipe, but finding one that matches your taste takes some effort. The ideal loan should fit your financial situation like a glove, with reasonable terms and a straightforward application process. Most importantly, it should solve your immediate money problems without becoming tomorrow’s financial headache.

Evaluating your financial needs

Before you dive into loan applications, take a moment to figure out exactly how much money you need. Borrowing too little is like bringing a water gun to a house fire – it won’t solve your problem. On the flip side, borrowing too much creates unnecessary debt that you’ll be paying off long after the emergency is resolved.

Be specific about the amount you need for your situation. If your car needs repairs, call the mechanic and get an actual estimate rather than guessing. Facing medical bills? Gather all those statements from AdventHealthAdvent Health, or Orlando Regional before deciding on a loan amount. This precision helps you avoid both coming up short and taking on extra debt.

Next, take a hard look at your current income and expenses. Pull up your bank statements from the past couple of months and map out:

- Where your steady money comes from

- What you absolutely must pay each month (rent, utilities, groceries)

- What you already owe to others

- What’s left after essential expenses

This financial snapshot shows what you can realistically allocate toward loan payments without skipping meals or missing rent. Remember that loan payments typically hit your account biweekly or semimonthly rather than once a month, so plan your budget accordingly.

Your banking history and employment stability matter more than you might think. Lenders look beyond credit scores to examine your banking activity, consistent deposits, and overall financial management. Having this information organized before you apply can speed up the whole process significantly.

Comparing online lenders vs. traditional banks

When you’re seeking a personal loan in Orlando, you’ll face a fundamental choice: go with an online lender or stick with a traditional bank. Each path has its own set of benefits depending on what matters most to you.

Online lenders have gained massive popularity for good reason. Their streamlined application process eliminates the need to dress up, drive across town, and wait in line just to fill out paperwork. Instead, you can apply entirely from home – maybe even in your pajamas while watching the Magic game – often completing the whole application in just five minutes.

Speed is where online lenders truly shine. Submit your application before 3:30 PM EST, and you might see approval the same day, with funds landing in your checking account by the next business day. Some lenders even offer same-day funding if you’re approved early enough. When your car is sitting dead in the driveway or your AC has quit during a Florida heat wave, this quick turnaround can be a lifesaver.

What’s more, online lenders typically look at your whole financial picture rather than just a credit score number. This broader assessment creates opportunities for borrowers in various situations, including those whose credit history might have a few blemishes.

Traditional banks, by contrast, generally move at a more leisurely pace. Their applications often require in-person visits and stacks of documentation, with approval decisions that might take days or weeks rather than hours. It’s like the difference between microwave and conventional oven cooking – they both get the job done, but one takes significantly longer.

For borrowers with stellar credit and no urgent need for funds, traditional banks sometimes offer lower interest rates. But when time is of the essence, the convenience and quick access to funds make online lenders particularly attractive.

A word of caution, though: be wary of lenders advertising “instant approval” or “guaranteed funds” regardless of credit. Responsible Florida lenders offer clear, regulated lending options with transparent terms rather than promises that seem too good to be true.

What to look for in loan terms

The fine print might not make for exciting reading, but understanding loan terms thoroughly is crucial for making smart borrowing decisions. These details determine not just how useful the loan is today but how it affects your finances tomorrow.

First, examine the payment schedule structure. After approval, you should receive a clear schedule showing specific due dates and payment amounts (though your final payment might be slightly smaller). Make sure this schedule aligns with when you get paid:

- Bi-weekly payments that match your regular paydays

- Semi-monthly payments for those paid twice a month

- Weekly payments if your income arrives weekly

Next, check for payment flexibility. Quality lenders let you pay more than the scheduled amount without penalties when you have extra cash. This flexibility helps you reduce the loan duration and potentially save money on interest. Automatic ACH withdrawals from your checking account ensure you never miss a payment date while giving you one less thing to remember each month.

The transparency of fee structures deserves your full attention. Your loan offer should spell out:

- The exact amount you’re borrowing

- A complete payment schedule with specific dates

- Equal payment amounts (except possibly the final payment)

- Full disclosure of all fees and terms

Repayment flexibility makes a huge difference in how manageable your loan feels. Florida installment loans typically offer structured repayment schedules that help you manage your finances without feeling overwhelmed each payday.

It’s worth noting that Florida law permits you to have only one active installment cash advance at a time. This regulation helps prevent the snowball effect of accumulating multiple high-interest debts and protects you from overextending yourself financially.

When emergencies strike, funding speed becomes paramount. Applications completed before 3:30 PM EST typically receive the fastest processing. Need money on the weekend? Some lenders offer instant funding options if you provide a debit card since standard ACH transfers don’t process on Federal Reserve holidays and weekends.

Finally, don’t underestimate the importance of accessible customer service. Quality lenders provide responsive support teams that can work with you if your financial situation changes during your repayment period. When life throws another curveball (and in Florida, it always does), you’ll want someone helpful on the other end of the line.

By thoroughly evaluating these factors—your specific financial needs, lender options, and loan terms—you can secure a personal loan that addresses your immediate financial emergency while remaining manageable for your budget. This thoughtful approach ensures your loan solution helps rather than hinders your journey toward financial health.

Applying for Quick Cash: Step-by-Step Guide

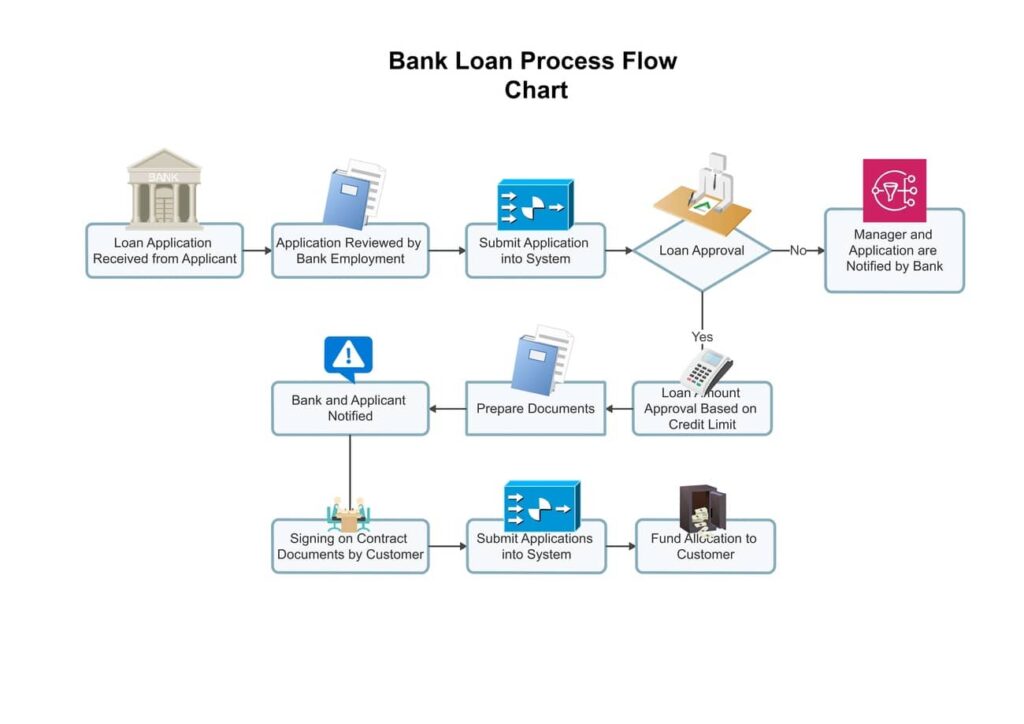

Image Source: Wondershare EdrawMax

You’re sitting at your kitchen table, staring at that unexpected car repair bill, wondering how you’ll manage to cover it before payday. The good news? Getting quick cash through personal loans in Orlando is simpler than you might think. The online application process is designed with busy Floridians in mind – taking just five minutes to complete. No need to fight I-4 traffic to visit physical locations or drown in mountains of paperwork.

Preparing your information

Think of this like packing for a Florida beach day – you’ll have a much better time if you gather everything you need before you start. Getting organized before your application can dramatically speed up the approval process and get money in your account faster.

First things first, you’ll need a government-issued photo ID, like your Florida driver’s license. This basic requirement helps lenders verify who you are while protecting against fraud. Having your ID handy before you start prevents those frustrating delays during verification. It’s like having your SunPassSun Pass ready before hitting the toll plaza – just makes everything move more smoothly.

Recent pay stubs are your proof that you’ve got a steady income coming in. These documents show lenders you’ll be able to make those repayments when they come due. Most lenders want to see pay stubs from the past 30 days to confirm you’re receiving consistent income.

Your banking information plays a starring role in both getting approved and receiving your funds. Be ready to provide:

- Your checking account and routing numbers for direct deposit

- Recent bank statements showing those regular income deposits

- Banking history that demonstrates how you manage your money

You’ll also need proof that you live in Florida – typically a utility bill or lease agreement with your Orlando address. This documentation, along with your social security number and contact information, rounds out the basic requirements for most personal loan applications.

Remember, lenders look beyond just traditional credit criteria. They also examine your current banking activity, how stable your employment is, and whether you have consistent income deposits. This bigger-picture approach creates opportunities for Orlando residents in all kinds of financial situations – even if your credit history has a few bumps along the way.

The 5-minute application explained

The online application process has been streamlined to be lightning-fast – often taking just five minutes from start to finish. When you’re facing an urgent air conditioning repair in the middle of a Florida summer, this speed is not just convenient – it’s essential.

To get started, head to the lender’s website and find their application form. The interface is designed to be user-friendly, with clear instructions guiding you through each step. Think of it as ordering from your favorite food delivery app – straightforward and designed to get you what you need quickly. The application asks for three main types of information:

- Personal details: This includes basics like your full name, date of birth, social security number, and how to contact you. These essentials establish who you are and how the lender can reach you throughout the process.

- Employment information: You’ll provide details about where you work, your job title, how long you’ve been employed there, and how often you get paid (weekly, bi-weekly, or semi-monthly). This information helps determine your payment schedule and shows you can repay the loan.

- Banking details: You’ll enter information about the checking account where you want your funds deposited. This same account will typically be used for automatic payments during repayment.

As you complete each section, the system securely sends your information to a scoring system that assesses whether you qualify. This evaluation looks at both the information you’ve provided and additional third-party data to create a complete picture of your financial situation.

The entire process happens digitally – no faxing documents or mailing paperwork. You can complete your application from any device with internet access, whether you’re at home on your laptop, on your phone during lunch break, or at the auto repair shop waiting for a cost estimate. This accessibility makes the process available to Orlando residents regardless of where they are or when they need to apply.

What happens after you submit

Once you hit that submit button, the verification process kicks into gear immediately. The system analyzes your information and usually provides an initial response within minutes – no need to wait by the phone for days wondering what’s happening.

In some cases, lenders might ask for verification documents to confirm what you entered in your application. These typically include the items we mentioned earlier – pay stubs, bank statements, ID, and proof of residence. Most lenders now provide secure online portals where you can upload these documents directly, so you don’t have to mess with printing, faxing, or mailing anything.

When you apply matters. Applications submitted before 3:30 p.m. EST generally see the fastest processing times. If you’re approved before this cutoff, you’ll typically receive funding the same day – perfect when that car repair can’t wait. Applications approved between 3:30 p.m. and 8:00 p.m. EST usually receive funding the next business day.

Upon approval, you’ll receive a detailed loan offer outlining:

- The exact amount you’re borrowing

- A complete payment schedule showing specific due dates

- Equal payment amounts (though the last payment might be slightly smaller)

- Full disclosure of all fees and terms

Take time to review these terms carefully before accepting the offer. The payment schedule will align with how frequently you get paid, whether that’s weekly, biweekly, or semi-monthly.

After you accept your loan offer, the funds travel directly to your checking account through an ACH transfer. Need money on the weekend for an emergency? Some lenders offer instant funding options if you provide a debit card since regular ACH transfers don’t process on Federal Reserve holidays and weekends.

Your payment schedule begins after your funds arrive. Payments typically process through automatic ACH withdrawals from your checking account on the specified dates. The system automatically adjusts for banking holidays and weekends, helping you maintain consistent payments without late fees.

One of the best features of these payment plans is their flexibility. You can make extra payments on due dates without any penalties, potentially reducing your overall loan term and interest costs. This gives you a path to becoming debt-free faster while still addressing your immediate financial needs.

For those who are already customers making repayments, the process is even simpler. Just log into your account on the lender’s website to create payment requests or confirm automatic withdrawals. The system handles the rest, automatically withdrawing the repayment from your checking account on your due date – you just need to make sure the money is there.

How Approval Decisions Are Made

Ever wonder what happens behind the digital curtain after you submit your loan application? The approval process for personal loans is far more sophisticated than most Orlando residents realize. While your credit score might be front of your mind, lenders are looking at a much bigger picture. Understanding how these decisions are made helps you better prepare your application and set realistic expectations about when funds might hit your account.

Factors lenders consider beyond credit scores

Think of your financial life as a movie rather than a snapshot. Traditional banks might only look at the poster (your credit score), but online lenders want to watch the whole film to understand your financial story.

Most online lenders in Orlando use advanced scoring systems that evaluate your complete financial picture. This comprehensive approach creates opportunities for people whose credit histories might not reflect their current financial responsibility.

Your banking activity tells lenders volumes about your financial habits. They’ll typically examine:

- Those consistent income deposits match what you reported about your job

- How you manage your account balances from month to month

- Transaction patterns that show financial responsibility (or lack thereof)

- Any history of overdrafts or bounced payments

Employment stability serves as another powerful indicator of how likely you are to repay. If you’ve held the same job at Universal or Disney for years, you’ll often receive more favorable consideration than someone who job-hops every few months. Having documentation of steady employment strengthens your application considerably.

Your current income sources and how regularly they arrive matter tremendously. Regular, verifiable income gives lenders confidence that you can meet those repayment obligations. At the same time, they’re looking at the balance between what you earn and what you’re asking to borrow – requesting a $5,000 loan on a $25,000 annual salary raises different questions than the same loan on a $75,000 salary.

Remember, lenders also examine overall financial management patterns that might not appear on traditional credit reports. They’re looking for signs that you handle money responsibly, even if past challenges have affected your credit score.

The verification process

After you hit “submit” on your application, lenders swing into action to verify everything you’ve told them. This process typically includes reviewing documentation and cross-checking your application details with information from third-party sources.

The system first conducts an automated review of your application data, looking for completeness and consistency. After this initial screening, you may receive requests for specific verification documents, typically including:

- A government-issued photo ID (your Florida driver’s license or passport)

- Recent pay stubs showing your consistent income

- Bank statements that confirm those regular deposits

- Proof that you live where you say you do, like utility bills or a lease agreement

The days of faxing documents or mailing photocopies are largely behind us. Most lenders now provide secure online portals where you can upload these documents directly. This streamlined approach eliminates delays while keeping your sensitive information protected. The verification process mainly focuses on confirming three things: who you are, how much you earn, and where you live.

This verification helps lenders understand your financial situation beyond what a credit check might reveal. Even if your credit history has some bumps and bruises, you might still qualify based on your current banking activity and steady income. Having these documents ready before you apply can significantly speed up the verification process – it’s like having your FastPassFast Pass ready at Disney World rather than waiting in the regular line.

Understanding approval timelines

The speed of your approval depends primarily on three factors: when you submit your application, how complete your information is, and what verification documents are needed. Florida regulations allow individuals to have only one active installment cash advance at a time, which lenders must verify as part of their process.

Applications submitted before 3:30 PM EST typically see the fastest processing times. If you’re approved before this cutoff, you’ll likely receive funds the same day – perfect when that mechanic is waiting for payment. Applications approved between 3:30 PM and 8:00 PM EST are generally funded the next business day.

Weekend and holiday approvals work differently since ACH transfers don’t process during these periods. However, some lenders offer instant funding options through debit card deposits for weekend approvals, ensuring you don’t have to wait until Monday to handle that emergency.

How quickly verification happens depends largely on how promptly you provide documents. When additional verification is needed, delays can occur. Submitting clear, legible documentation as soon as it’s requested helps minimize these delays and gets money in your account faster.

After approval, you’ll receive a detailed loan offer showing:

- The exact amount you’re borrowing

- A complete payment schedule with specific dates

- Equal payment amounts (though your final payment might be slightly smaller)

- Full disclosure of all fees and terms

Your payment schedule will align with when you get paid – whether that’s weekly, bi-weekly, or semi-monthly. Most borrowers receive their funds through direct deposit shortly after approval, sometimes within hours, depending on their bank’s processing times.

Understanding these approval factors and timelines helps you navigate the personal loan process more effectively. When your AC fails in July or your car breaks down on the way to work, knowing realistically when funds will become available helps you make better plans for handling these pressing financial needs.

Receiving and Using Your Funds

Congratulations! Your loan application is approved, and now you’re eagerly checking your account balance every few hours. We’ve all been there – that mixture of relief and anticipation as you wait for the funds to arrive. The good news is that the funding process follows a predictable schedule, letting you plan your next steps with confidence.

Same-day and next-day funding options

When that money lands in your account depends largely on when you submitted your application. It’s like the difference between catching an early morning flight to Orlando versus an evening red-eye – timing matters.

Applications approved before 3:30 p.m. EST typically receive same-day funding. This means if your car repair shop is holding your vehicle hostage until payment, you might have your wheels back before dinner. Applications approved between 3:30 p.m. and 8:00 p.m. EST, however, will generally be funded on the next business day.

What about those weekend emergencies when the roof starts leaking during Saturday’s thunderstorm? You’re not completely out of luck. While standard ACH transfers don’t process on Federal Reserve holidays or weekends, many lenders offer an instant funding alternative. To tap into this weekend rescue option, you’ll need to provide debit card information, allowing the lender to deposit funds even when banks are taking their days off.

Remember: Banking systems aren’t all created equal. Even when funds are sent immediately, your bank’s specific processing times affect when the money becomes available in your account – some banks are speedboats, and others are more like pontoons.

Direct deposit process

Once approved, your money travels directly to your checking account through a secure ACH transfer system. No need to wait for a paper check in the mail or make a special trip to the bank. This electronic handoff eliminates paperwork and creates a smooth journey from approval to funding.

The ACH system works through third-party payment processors that securely shuttle money between financial institutions. Occasionally, these processors hit speed bumps during federal holidays, which might slightly extend your transfer timeline.

After approval, you’ll receive a detailed payment schedule showing:

- Exact payment dates that line up with when you get paid

- Equal payment amounts (though your final payment might be a bit smaller)

- Complete fee structure and terms

Your payment schedule is tailored to match your income pattern, with options including:

- Bi-weekly payments for those who get paid every other Friday

- Semi-monthly payments for the 15th and 30th payday crowd

- Weekly payments for those collecting a paycheck every week

This alignment between when money comes in and when payments go out makes budgeting substantially easier – it’s like synchronizing your watch with the person you’re meeting for lunch so nobody’s left waiting.

Smart ways to use your personal loan

Now that you’ve got the money, how should you use it? Personal loans in Orlando serve many legitimate financial needs. Using these funds wisely helps keep your financial boat afloat while addressing the immediate leak.

Car repairs top the list of practical uses, especially in a spread-out city like Orlando, where your car is often your lifeline to employment. That strange noise your Toyota has been making for weeks won’t fix itself, and ignoring it could mean the difference between a simple repair now and being stranded on I-4 during rush hour later.

Medical expenses represent another responsible use of personal loan funds. Whether it’s an unexpected ER visit or a dental emergency that can’t wait, health needs don’t politely schedule themselves for when you have extra cash on hand.

Home repairs constitute a common emergency for Florida residents. From air conditioning units that surrender during July’s sweltering heat to hurricane damage that can’t wait until next month’s paycheck, these situations demand prompt financial attention. A functioning AC in Florida isn’t a luxury – it’s practically a survival necessity.

Utility bills facing disconnection present another valid use case. Keeping the lights on and water running often proves much less expensive than paying those hefty reconnection fees after services are cut off. Plus, trying to survive a Florida summer without electricity is not an experience anyone recommends.

The silver lining in all this? The flexible payment structure of personal loans makes repayment manageable. Unlike payday loans that demand full repayment by your next paycheck (like trying to drink the ocean through a straw), installment loans spread payments across multiple pay periods. This structured approach, combined with the freedom to make extra payments without penalties, provides a clear path to becoming debt-free faster.

Florida law permits you to have only one active installment cash advance at a time. This regulation encourages responsible borrowing while preventing the snowball effect of accumulating multiple high-interest debts. The automated payment system handles the heavy lifting, withdrawing your scheduled payment on due dates and even adjusting for banking holidays and weekends to help maintain consistent payments. It’s like having a financial assistant who never takes a day off.

Successful Repayment Strategies

Once you’ve got your loan and addressed that pressing financial need, the journey isn’t over. Now comes the part that truly determines your financial success – repayment. Think of your repayment strategy like planning a road trip across Florida: with good planning and navigation, you’ll reach your destination smoothly, even if you encounter a few unexpected detours along the way.

Setting up automatic payments

Picture this: It’s Friday evening, and you’re relaxing after a long work week when, suddenly, you bolt upright, remembering a loan payment due that day. With automatic payments, that scenario vanishes from your life forever.

ACH withdrawals from your checking account work like a financial autopilot for your personal loan. This automated system ensures your payments arrive on time by processing withdrawals on scheduled due dates. When a due date falls on a Sunday or bank holiday, the system automatically adjusts, helping you avoid those pesky late fees without having to mark your calendar with exceptions.

The key to making this system work for you? Keep enough money in your account on payment dates. It’s like making sure your gas tank is filled before a long drive – a little preparation prevents a lot of problems. This careful planning helps you steer clear of overdraft fees that could otherwise complicate your financial journey.

Aligning payments with your pay schedule

There’s nothing worse than having a loan payment due three days before your paycheck arrives. Thankfully, when you get approved, you’ll receive a detailed payment schedule showing exactly when payments are due and for how much. These schedules are typically designed to match when you receive income, with several options available:

- Bi-weekly payments that line up with those every-other-Friday paychecks

- Semi-monthly payments for those paid on the 15th and 30th

- Weekly payments if your employer pays you every week

This alignment creates a repayment plan that fits into your life like your favorite pair of sandals – comfortable and easy to live with. When your income and outgo are synchronized, you’re much less likely to miss payments or come up short when they’re due.

Benefits of paying more than the minimum

One of the best features of personal loans is the ability to pay more than your scheduled amount without getting hit with penalties. It’s like finding an express lane on the Florida Turnpike when you’re in a hurry – a faster way to reach your destination.

This flexibility provides some significant benefits:

- Shorter loan duration by accelerating your repayment

- Potential savings on interest over the life of your loan

- Quicker path to being completely debt-free

Say you get a nice work bonus or tax refund – you can apply that windfall to your loan and take a big chunk out of your remaining balance. The option to make these extra payments puts you in the driver’s seat of your repayment timeline, allowing you to adjust based on your changing financial situation.

Remember, every extra dollar you pay goes toward reducing your principal balance, which means less interest over time. It’s like paying for a 7-day Disney vacation but leaving after 5 days – you still got the full experience but saved money in the process.

How many installment loans can you have in Florida?

While developing your personal repayment strategy, it’s important to understand Florida’s regulatory landscape. Florida law allows individuals to have only one active installment cash advance at a time. This rule isn’t meant to limit your options – it’s designed to protect you from the financial quicksand of juggling multiple high-interest debts simultaneously.

Think of it as a guardrail on the financial highway. These regulations prevent you from accumulating multiple loans that could quickly become overwhelming, much like how a traffic light prevents chaos at a busy intersection. By focusing on repaying one loan before taking on another, you maintain a clearer path toward financial stability.

This “one at a time” approach encourages a more mindful relationship with borrowing. Instead of spreading your attention across multiple payment schedules, interest rates, and due dates, you can focus on successfully managing a single obligation. It’s like the difference between trying to follow three GPS directions at once versus focusing on a single clear route – the latter is much more likely to get you where you want to go.

Conclusion

When life throws you a financial curveball – whether it’s your AC giving up during an Orlando heat wave or your car deciding to quit right before a big job interview – personal loans can be your financial lifeline. Through streamlined online processes, these loans offer Orlando residents reliable solutions for those “I need money now” moments that seem to pop up at the worst possible times.

You might appreciate how quickly applications take you from “financial panic” to “problem solved” without drowning in paperwork. The flexible payment schedules align with your actual payday – not some arbitrary date that leaves you scrambling. Whether you’re paid bi-weekly or semi-monthly, your loan payments can match that rhythm, making budgeting significantly easier.

Payment flexibility means you can pay extra when you have it without getting hit with penalties. Found an extra $100 in your budget this month? Put it toward your loan and shorten your repayment timeline. This flexibility helps you break free from debt faster while keeping your financial ship steady through sometimes choppy waters.

My Funding Choices stands ready to help Orlando residents who need quick access to funds. Their transparent terms mean no surprises hiding in the fine print, and their streamlined verification process often leads to same-day or next-day funding when you submit your application before those all-important cutoff times.

Remember, successful management of your personal loan boils down to a few simple principles: borrow only what you truly need, understand your payment schedule completely, and maintain consistent payments through those convenient automated withdrawals. This responsible approach ensures you solve today’s financial emergency without creating tomorrow’s financial headache.

FAQs

Q1. How quickly can I get approved for a personal loan in Orlando?

Many online lenders offer fast approval processes, with decisions often made within minutes of applying. If approved before 3:30 PM EST, you may even receive same-day funding.

Q2. What factors do lenders consider besides credit scores?

Lenders look at various factors, including banking activity, employment stability, consistent income deposits, and overall financial management patterns. This comprehensive approach allows for a more holistic evaluation of your financial situation.

Q3. Can I make extra payments on my personal loan without penalties?

Yes, most lenders allow borrowers to make additional payments on due dates without incurring penalties. This flexibility can help you reduce the loan duration and potentially save on interest costs.

Q4. How do personal loans compare to payday loans?

Personal loans typically offer larger amounts, longer repayment terms, and more manageable payment schedules compared to payday loans. They also tend to have lower interest rates and don’t require full repayment by the next paycheck.

Q5. How many installment loans can I have at once in Florida?

Florida law permits individuals to have only one active installment cash advance at a time. This regulation helps prevent the accumulation of multiple high-interest debts and encourages responsible borrowing.